tax service fees fha loans

What is a tax service fee FHA. As part of the US.

Appraisal - if ordered in Veterans Name.

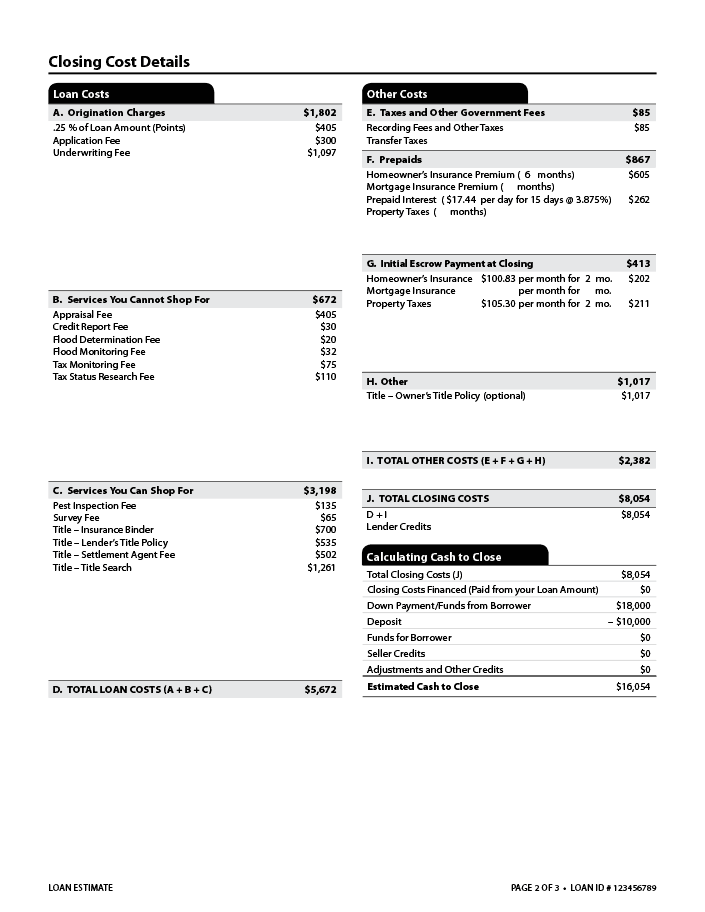

. The one percent fee cap was eliminated. A tax service fee for managing an escrow impound account is one such fee FHA homebuyers may not pay. For loans through the end of 2009 the origination fee was limited to one percent.

The seller or lender must pay the non-allowable tax service fee which typically costs about 25 to 75 according to the Good Mortgage website. Test and certification fees. The lender or any of the lenders employees must not pay or receive or permit any other party.

Can you charge a tax service fee on an FHA loan. FHA loans often involve a tax service fee for the management of the escrow impound account. A tax service fee directly benefits the loan servicing company or the.

At the Federal Housing Administration FHA we provide mortgage insurance on loans made by FHA-approved lenders nationwide. 63015 Are referral fees allowed in the origination of FHA- insured single family loans. The tax service fee is typically paid by the buyer to the lender at the time the home is purchased.

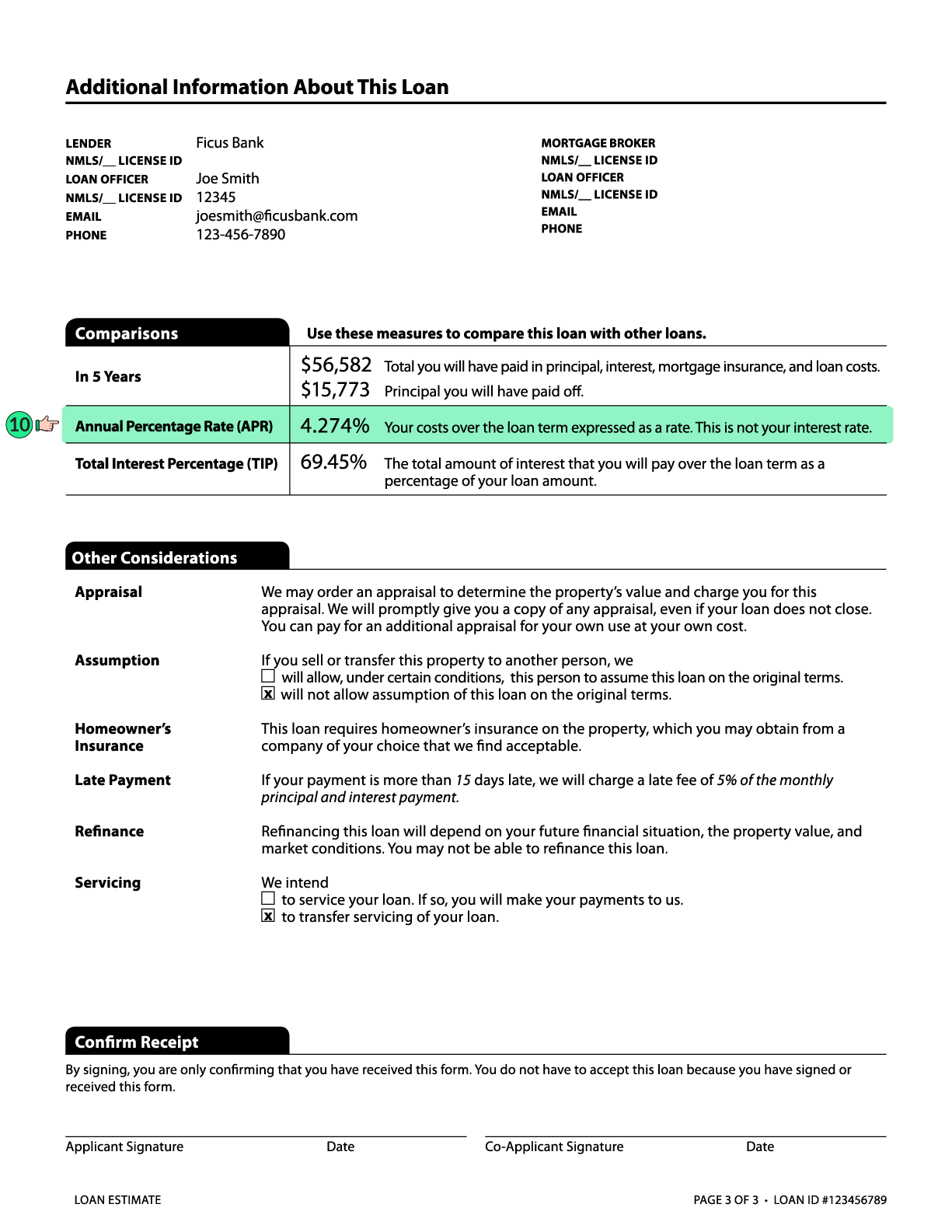

The answer to this question. The tax service fee is one of a variety of closing costs or fees assessed when a mortgage becomes official and a home sale is completed. If you do not include the amount owed in late fees in your remittance it will be subtracted from the amount that is applied to your premium.

Credit reports actual costs Transfer stamps recording fees and taxes. Tax service fees are. The gist of the questioncan an FHA loan applicant be charged a tax service fee as part of closing costs or other loan-related fees and expenses.

VA and FHA loans. Document Draw Fee if required for Buyer Notary Fee. Tax service fees are closing costs that are assessed as a means of making sure that mortgage holders pay property taxes in a timely manner.

You may face additional penalties based on the. Tax Service Fee 50 This fee is paid to research the existing property taxes. What is a tax service fee FHA.

Home inspection fees up to 200. Allowed in an FHA refinance loan are wire transfer. The tax service fee is one of a.

The same letter prohibited loan origination fees of more than 1 percent. For example FHA rules allow the lender to collect an origination fee. Title Insurance - ALTA.

Mortgagee Letter 06-04 virtually eliminated the prohibited closing costs with the exception of the tax service fee. Tax Service Fee 50 This fee is paid to. Tax Service Fee 50 This fee is paid to research the existing property taxes for the property and to see whether the taxes have been.

The Best Lenders For Fha Loans In October 2022

Tax Preparation Services Options Costs For Filing Taxes

Tax Service Fees For Va Fha Loans Hud Handbook

Fha Loans Requirements Limits And Rates Rocket Mortgage

Fha Closing Costs Complete List And Estimate Fha Lenders

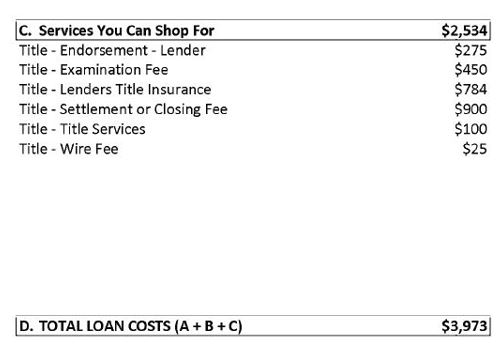

Loan Estimate Explainer Consumer Financial Protection Bureau

:max_bytes(150000):strip_icc()/dotdash-hud-vs-fha-loans-whats-difference-Final-0954708337654015b47b723ebc306b0f.jpg)

Hud Vs Fha Loans What S The Difference

Mortgage Escrow What You Need To Know Forbes Advisor

Garden State Home Loans Review Nextadvisor With Time

Fha Fha Open The Door To Success And Profit With Fha Ppt Download

Can Homebuyers With Fha Loans Compete In Today S Housing Market

:max_bytes(150000):strip_icc()/fhaloan.asp-V1-773ce9699c13471b9bf8f53e7d3824d5.png)

Federal Housing Administration Fha Loan Requirements Limits How To Qualify

Tax Service Fees For Va Fha Loans Hud Handbook

Understanding Closing Costs Sirva Mortgage

Fha Closing Costs For 2021 Nerdwallet

Fha Loan Requirements For 2022 Nerdwallet

Rocket Mortgage Vs Loandepot Which Mortgage Lender Is Best For You Nextadvisor With Time

:max_bytes(150000):strip_icc():gifv()/GettyImages-1333062121-d0385fd64e7f4cfdbb0cf3dfe877e911.jpg)